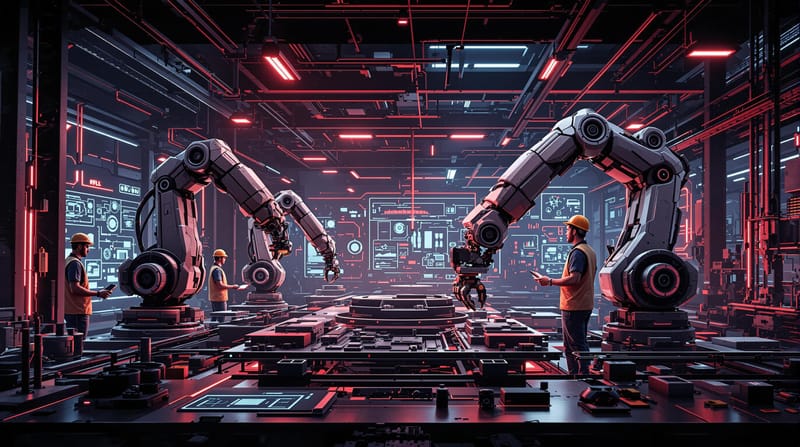

Why Supply Chains Are Still Chaos for Manufacturers

Political conflicts, chip shortages, and workforce issues are causing chaos in supply chains, impacting manufacturers' operations and profits.

Supply chains remain disrupted, impacting profits, production, and national security. Here’s what’s driving the chaos:

- Political Conflicts: Wars and tensions (e.g., Russia–Ukraine, U.S.–China) disrupt critical supplies like neon and semiconductors, affecting industries worldwide.

- Semiconductor Shortages: Chips, essential for everything from cars to defense, face production bottlenecks and counterfeit issues, delaying timelines by years.

- Workforce Shortages: Trucking, warehousing, and manufacturing jobs remain unfilled, leading to shipment delays and reduced output.

Key Impacts

- Production Delays: Aircraft, cars, and even military equipment face years-long delays.

- Rising Costs: Material prices, inflation, and cybersecurity threats increase expenses.

- Financial Losses: Companies lose billions annually due to disruptions.

Solutions

- Reshoring Production: Bring manufacturing closer to home to improve reliability.

- Digital Tools: Use blockchain and digital twins to track and predict supply chain issues.

- Broader Supplier Networks: Diversify suppliers to reduce risks.

Manufacturers must act now to stabilize operations and protect their bottom lines.

3 Main Causes of Supply Chain Problems

Global Political Conflicts

The Russia–Ukraine war and growing U.S.–China tensions have disrupted global supply chains significantly. Around 560,000 U.S. businesses depend on suppliers in Russia and Ukraine, which provide over 85% of the world's semiconductor-grade neon supply [1]. On top of that, China produces 30% of semiconductor components in the 50- to 180-nanometer range [3]. These disruptions have ripple effects across industries.

For instance, Thomson Plastics has seen its profit margins shrink to just one-third of pre-pandemic levels as of January 2025 due to a spike in natural gas costs and inflation caused by conflicts. The closure of European airspace to Russian airlines has further complicated goods movement between Europe and Asia [2]. These political tensions exacerbate chip shortages, destabilizing the supply of crucial components.

Chip Supply Shortfalls

The semiconductor crisis continues to disrupt manufacturing in multiple sectors. Taiwan Semiconductor Manufacturing Co. (TSMC) is responsible for over 60% of global semiconductor production and more than 90% of the most advanced chips, creating a bottleneck that results in wait times of 36–99 weeks [6]. The defense sector is particularly affected. According to Frank Cavallaro, CEO of A2:

"Today, the military is more a consumer of technology than a driver and is at the whims of commercial supply chains, especially when it comes to semiconductors." [4]

Adding to the problem, a Senate Armed Services Committee investigation revealed that counterfeit electronics cost the semiconductor industry $7.5 billion annually. Shockingly, 15% of spare or replacement semiconductors purchased by the U.S. Pentagon were found to be counterfeit [5].

Workforce Shortages

Acute workforce shortages are hitting supply chain and logistics operations hard, with 76% of these organizations reporting significant challenges [8]. The trucking industry alone faces a shortfall of 80,000 drivers, projected to double to 160,000 by 2030 [7]. Manufacturing isn't faring much better, with nearly 603,000 positions unfilled as of May 2024 [9]. Transportation and warehousing are particularly strained:

| Area | Impact Level | Effect on Operations |

|---|---|---|

| Transportation | 61% affected | Severe shipment delays |

| Warehouse Operations | 56% affected | Reduced processing capacity |

| Customer Service | 58% impacted | Declining service levels |

Chad Moutray, Chief Economist at the National Association of Manufacturers, points out:

"There's no such thing as a low-skilled job in manufacturing anymore." [9]

These labor shortages are expected to persist with an aging workforce and changing career preferences.

Direct Business Impacts

Production Delays

Manufacturing is grappling with major setbacks in production timelines. Take Boeing's new Air Force One project: once slated for delivery in December 2024, it’s now pushed back to 2029 or later. The reasons? Supplier bankruptcies and shortages in key components [11].

GE Aerospace faces a similar challenge. The company saw a 10% drop in deliveries of its CFM International Leap turbofan engines in 2024 compared to 2023. Supply chain disruptions and material shortages were the main culprits. Rahul Ghai, GE Aerospace’s CFO, summed it up:

"Supply chain constraints impacted total deliveries" [10]

Aircraft manufacturers are scrambling to adjust their production goals:

| Manufacturer | Current Production | Target Production | Delay Timeline |

|---|---|---|---|

| Airbus | 44 A320s/month | 75/month | Pushed to 2027 |

| Boeing | Below target rate | 38 737 MAX/month | May extend to 2026 |

| Lockheed Martin | 110 F-35s (2024) | Increased from 97 (2023) | On track |

These delays bring added cost pressures that are hard to ignore.

Cost Increases

Rising costs for raw materials and operations are straining businesses. A recent survey found that 78% of European business leaders are dealing with inflation's impact on their supply chains, and 20% have seen costs jump by more than 10% year over year [13]. Forecasts suggest raw material prices will climb another 3.2% in early 2024 [12].

Cybersecurity threats are another growing expense. On average, breaches now cost manufacturers $4.47 million - a 5.4% increase [12]. Meanwhile, reconstruction costs have surged by over 40% since late 2019 [12].

"Time is money, and the longer it takes to receive parts, the longer it takes to do the production, you're inevitably going to see costs coming up" [12]

These rising expenses are cutting into already thin profit margins for smaller companies.

Financial Losses

The financial toll is mounting. Surveys show that 71% of large companies are struggling with raw material price hikes, 50% cannot ship goods on schedule, and 23% of smaller firms are facing financing hurdles [15].

Adding to the pressure, China's potential control over 40-50% of the global rare earth oxide (REO) supply poses a serious risk to manufacturers of advanced defense components [16]. In response, 62% of suppliers are expanding their second-tier networks to build resilience [15].

"COVID challenged us to say how do we make our money, and is it all about low cost? Because if you're not on the shelf, all of that cost is lost quite quickly" [14]

Why Global Supply Chains May Never Be the Same

3 Ways to Fix Supply Chains

With production still facing disruptions, these strategies offer practical ways to move forward.

Local Production Shift

Manufacturers in the U.S. are increasingly relocating their operations home, with 69% already reshoring their supply chains [17]. This shift improves quality control, trims transportation costs, and speeds up lead times. However, challenges like higher labor expenses and limited infrastructure remain.

To address these hurdles, companies are using specific strategies:

| Strategy Component | Implementation Approach | Expected Outcome |

|---|---|---|

| Cost Management | Invest in automation and advanced technology | Offset higher domestic labor costs |

| Government Support | Use available incentives and grants | Ease the financial burden of transitioning |

| Local Partnerships | Work with domestic suppliers | Build a reliable, localized network |

| Transition Timeline | Gradually phase in domestic operations | Reduce disruption during the change |

While reshoring is gaining traction, digital tools also reshape supply chain resilience.

Supply Chain Modeling

Digital twin technology offers a way to predict and prevent supply chain issues before they occur. This market is expected to grow to $125–$150 billion by 2032, with annual growth rates of 30–40% [18]. For example, one consumer-packaged goods company cut distribution costs by 15% by analyzing warehouse demand and labor patterns with digital twins. Similarly, using this technology, a global OEM reduced freight and damage costs by 8% [18].

Another advanced tool is blockchain-based parts tracking, which enhances visibility and cuts costs. For high-value components, permissioned blockchain creates a secure, unchangeable record of transactions, enabling real-time tracking across partners [20]. Its benefits include a 15% increase in trade volume and a potential 5% boost to U.S. GDP [19]. Blockchain reduces counterfeiting risks, streamlines recalls, ensures compliance, and improves supplier accountability.

"Blockchain can help address some of the key challenges that the supply chain industry faces today...Deloitte encourages enterprises to consider blockchain solutions as a possible antidote to their supply chain challenges." [20]

These technologies improve supply chain efficiency and contribute to economic and national security by ensuring reliable systems for critical components.

Conclusion

Problems and Solutions at a Glance

Supply chain disruptions remain a pressing issue, with over 80% of supply chain leaders predicting challenges persist or worsen through 2023 [21]. The first half of 2022 saw a nearly 50% spike in disruptions compared to 2021 [22]. On average, companies now face significant disruptions lasting a month or longer every 3.7 years [23]. These numbers highlight the urgent need for focused action.

The manufacturing sector has been particularly hard hit. Federal Reserve data shows that 23% of companies in this sector cite supply chain issues as a major constraint [22]. However, when applied effectively, approaches like reshoring, digital modeling, and improved tracking offer actionable solutions.

Key Actions for Manufacturers

Manufacturers need to act decisively to strengthen their operations. To create a balance between resilience and efficiency, here are some practical steps to consider:

| Focus Area | Steps to Take | Impact |

|---|---|---|

| Risk Assessment | Build a PPRR model (prevention, preparedness, response, recovery) | Better risk management [21] |

| Supplier Network | Broaden supplier base and communicate more frequently | Reduced dependency on single sources [21] |

| Technology Integration | Use predictive analytics and simulation tools | Improved ability to forecast disruptions [21] |

A consultant from KPMG put it succinctly:

"When disruption is constant, an organization's preparation for key supply chain trends can be a significant competitive advantage." - KPMG Management Consultancy [22]

These steps protect individual businesses and contribute to broader economic and security goals.

The Bigger Picture: National Security

Supply chain challenges impact more than profits—they directly affect national security. At least 25% of critical products in every region depend on external sources [24], creating vulnerabilities that require joint efforts between governments and businesses.

Examples of coordinated initiatives include:

- The EU's Health Emergency Preparedness and Response Authority (HERA)

- The US Council on Supply Chain Resilience

- Finland's National Emergency Supply Agency [24]

As noted:

"Securing the global supply chain, while ensuring its smooth functioning, is essential to our national security and economic prosperity" [25]

Manufacturers must make supply chain decisions with this broader perspective in mind. Operational resilience isn't just about staying competitive but safeguarding national security.