Is Nuclear Energy the Key to AI Data Centers?

Nuclear power emerges as a vital energy source to meet the surging demands of AI data centers, balancing reliability and sustainability.

AI data centers are consuming more energy than ever, with power demands expected to rise by 160% by 2030. Meeting this demand requires a mix of energy sources, and nuclear power is emerging as a strong candidate. Here's why:

- Rising Energy Needs: AI servers could use 500 terawatt-hours annually by 2027, straining grids.

- Nuclear's Advantages: Nuclear power is reliable 24/7, has low emissions, and has high energy density, making it ideal for AI operations.

- Challenges: High costs, regulatory hurdles, and public safety concerns remain barriers.

- Future Outlook: Small Modular Reactors (SMRs) and private investments (e.g., Microsoft, Amazon) signal growing momentum for nuclear energy.

Nuclear energy offers a reliable, low-carbon solution, but it must complement renewables and storage to meet the growing energy needs of AI. Read on to explore how nuclear power can power the future of AI.

AI Data Center Energy Requirements

Power Usage Stats

Power Usage Stats

In 2022, data centers used 4.4% of all electricity in the US, a jump from 1.5% in 2006 [3]. From 2015 to 2019, while workloads nearly tripled, overall energy use stayed steady thanks to efficiency gains [1]. However, the rise of AI is driving new demand. By 2030, data centers might consume up to 21% of global energy. AI-focused servers alone are expected to use 500 terawatt-hours annually by 2027 - a 2.6x increase from 2023 levels [6]. This growing demand puts added strain on the already stretched power grid.

Grid Capacity Issues

The North American Electric Reliability Corporation (NERC) predicts summer energy demand will rise by 15%, increasing capacity needs by 132 gigawatts, up from 80 gigawatts in earlier forecasts [5].

"The trends point to critical reliability challenges facing the industry: satisfying escalating energy growth, managing generator retirements, and accelerating resource and transmission development" [5]

Real-world examples from Loudoun County, Virginia, and Chicago show that many sensors detected power distortions exceeding industry limits [4]. These challenges highlight the urgent need for dependable power solutions.

Current Energy Source Limits

| Energy Source | Limitation | Operating Time |

|---|---|---|

| Utility-scale Solar | Inconsistent output | ~6 hours/day [1] |

| Wind Power | Fluctuating output | ~9 hours/day [1] |

| Natural Gas | High emissions impact | 24/7 availability |

The table shows why consistent, reliable energy is essential for AI data centers. With US data center electricity demand projected to grow by 400 terawatt-hours between 2024 and 2030 [7], stable power sources will be critical to effectively meet these needs.

Nuclear Power Basics

Nuclear power plants generate energy through uranium fission. This process releases heat, transforming water into steam and powering turbines connected to generators [8]. A single uranium pellet can produce as much energy as a ton of coal but without significant carbon emissions [11]. This renders uranium an efficient energy source, particularly for operations with high energy demands. For example, an Nvidia Blackwell chip can consume up to 2 kW—more than the typical household uses [10]. These energy efficiencies position nuclear power as a key player in powering AI data centers.

Nuclear Industry Status

Since 1990, the nuclear industry has consistently supplied about 20% of U.S. electricity. Recent advancements, like Small Modular Reactors (SMRs), make nuclear power more adaptable to specific applications, including data centers [8].

| Characteristic | Traditional Nuclear | SMR Technology |

|---|---|---|

| Power Output | ~1000+ MW | Up to 300 MW |

| Land Requirements | Large facilities | 40,000 m² (around 90% less) |

| Construction | On-site assembly | Factory-built, transportable |

| Refueling Frequency | 1–2 years | 3–7 years |

| Deployment | Fixed location | Flexible siting options |

"SMRs would be ready to 'plug and play' upon arrival [on site] and be more affordable." – Steven Chu, U.S. Secretary of Energy

Benefits and Risks

For AI data centers, nuclear power provides a mix of reliability and efficiency:

Advantages:

- Near-zero carbon emissions during operation [1]

- Continuous baseload power generation

- Requires 360 times less land than wind and 75 times less than solar [9]

- SMRs use about 60 L/MWh of water, compared to over 3000 L/MWh for traditional plants [9]

Risks:

- High upfront construction costs

- Complex regulatory hurdles

- Public safety concerns due to past incidents

- Challenges in managing nuclear waste [11]

- Security risks tied to nuclear materials

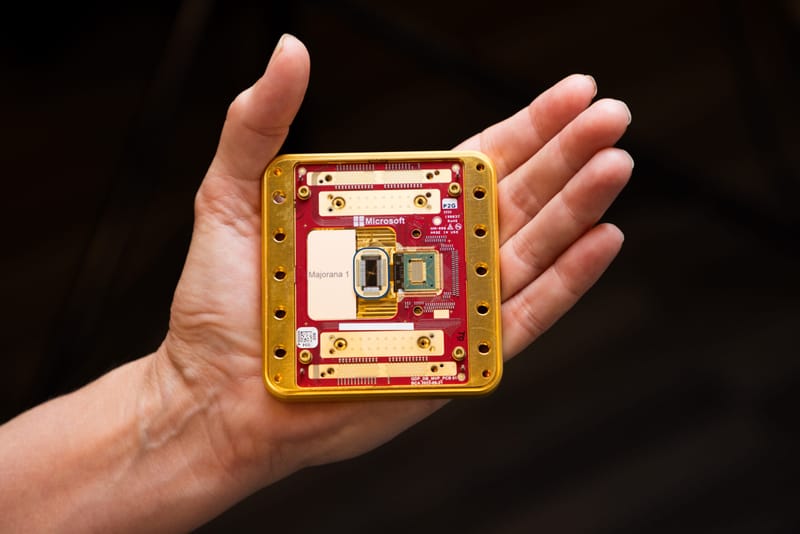

Momentum in the industry is growing. For example, Google has partnered with Kairos Power to target 500 MWe by 2035. Similarly, Microsoft’s $1.6 billion collaboration with Constellation Energy highlights increasing confidence in nuclear solutions for AI infrastructure [2].

Why Tech Giants Are Investing In Nuclear Power For AI Data Centers

Can Nuclear Power Run AI Data Centers?

Let’s dive into how nuclear power stacks up as an energy source for powering AI data centers.

Cost and Technical Analysis

The growing energy demand from AI data centers is both a challenge and an opportunity for nuclear power. By 2030, AI data centers in the U.S. could use up to 17% of the country's electricity supply [12]. Meeting this demand would require an additional 85–90 gigawatts of nuclear capacity [1]. However, current global projections suggest that only a fraction - less than 10% - of this capacity will be available by then [1].

Here’s how nuclear compares to other energy sources in terms of cost and availability:

| Power Source | Cost (per MWh) | Availability |

|---|---|---|

| Onsite Wind | $25 | ~9 hours/day |

| Solar | $26 | ~6 hours/day |

| Natural Gas + Carbon Capture | $91 | 24/7 |

| Large-scale Nuclear | $77 | 24/7 |

When a carbon price of $100 per ton is factored in, nuclear power becomes a more attractive option economically [1]. For example, the UAE's recent nuclear project, which included four units, cost around $30 billion [13].

Despite its potential, nuclear power faces hurdles in cost, capacity, and regulatory compliance, which we’ll explore further.

Safety and Legal Requirements

Nuclear energy facilities are tightly regulated, especially near urban centers or critical infrastructure like data centers. Modern reactor designs have dramatically improved safety, requiring minimal operator involvement and reducing the risk of human error [14] [15].

"Newer designs require a lot less operator intervention than the reactors of the past, which reduces the risk of human error and increases reliability and safety."

– Don Dermond, VP, Commissioning, JLL [14]

However, navigating the regulatory landscape remains a challenge. Specialized labor shortages and lengthy permitting processes complicate nuclear projects [1].

These obstacles mean companies must adopt creative strategies to integrate nuclear energy into their operations.

Company Examples

Some tech giants are exploring nuclear-powered solutions for their AI infrastructure to address these challenges. Here are two notable examples:

-

Microsoft's Three Mile Island Initiative

Microsoft has pledged $1.6 billion in partnership with Constellation Energy to restore the Three Mile Island nuclear plant. This project aims to provide carbon-free energy for 20 years [2]. -

Amazon's SMR Investment

Amazon is working with X-Energy Reactor Company on a $500 million initiative to develop over 5000 MWe of new power projects across the U.S. by 2039. This represents the largest commercial deployment of small modular reactors (SMRs) [2].

"Our conversations with renewable developers indicate that wind and solar could serve roughly 80% of a data center's power demand if paired with storage, but some sort of baseload generation is needed to meet the 24/7 demand... nuclear is the preferred option for baseload power, but the difficulty of building new nuclear plants means that natural gas and renewables are more realistic short-term solutions."

– Jim Schneider, Digital Infrastructure Analyst, Goldman Sachs Research [1]

Nuclear vs Other Power Sources

Solar and Wind Options

Renewable energy sources like solar and wind appeal to AI data centers because they are affordable. In the US, on-site wind power costs around $25/MWh, while solar energy is roughly $26/MWh [1]. However, their intermittent nature makes it difficult to meet the constant power needs of AI data centers [1].

"Our conversations with renewable developers indicate that wind and solar could serve roughly 80% of a data center's power demand if paired with storage, but some sort of baseload generation is needed to meet the 24/7 demand" [1].

Natural Gas Assessment

Natural gas is often seen as a short-term solution because of its relatively low upfront cost. Without carbon capture, it costs about $37/MWh [1]. However, when a carbon price of $100 per ton is factored in, the cost jumps to approximately $91/MWh [1].

In regions where gas supplies are limited, like Germany, the economics become less favorable:

| Power Source | Cost (USD/MWh) | Carbon Impact |

|---|---|---|

| Gas + Carbon Capture | 147 | Moderate |

| Wind/Solar (High End) | 152 | Minimal |

| First-gen SMRs | 331+ | Minimal |

While natural gas emits about half as much carbon as coal, it still falls short for companies aiming to meet strict environmental goals [16].

Mixed Power Solutions

These comparisons highlight the importance of combining multiple energy sources. A hybrid approach is necessary to ensure reliable energy for AI data centers. For instance, using a mix of solar, battery storage, and natural gas can cut emissions by about 67% compared to relying only on natural gas [1].

The ideal combination depends on the location and available resources:

- Natural gas with carbon capture: $91/MWh

- Renewable mix with storage: $87/MWh

- Large-scale nuclear: $77/MWh [1]

Goldman Sachs estimates that 40% of new capacity to support AI data centers will come from renewables, with the rest coming from other sources [1][17]. This underscores nuclear power's importance as a steady energy source that will work alongside renewables and natural gas to meet the growing demands of AI data centers.

Long-term Effects and Outlook

AI data centers are projected to consume over 160% more power by 2030 than in 2023, influencing how energy is produced and distributed [1]. According to the Electric Power Research Institute (EPRI), data centers may account for as much as 9% of U.S. electricity consumption by 2030, necessitating significant upgrades to energy infrastructure [2].

"Our outlook on power demand growth warrants an 'and' approach, not an 'or' approach, as we see ample opportunities for generation growth across sources"

- Brian Singer, Global Head of GS SUSTAIN in Goldman Sachs Research [1]

These changes are pushing tech companies to rethink their strategies for reducing carbon emissions.

Carbon Reduction Goals

Nuclear power is becoming a key option for tech companies aiming to meet stricter carbon reduction targets. If 60% of the increased energy demand from data centers is met with natural gas, global emissions could rise by 215–220 million tons [1].

Some major players are already turning to nuclear energy to meet their sustainability goals:

| Company | Nuclear Power Initiative | Expected Impact |

|---|---|---|

| Microsoft | $1.6B deal with Constellation Energy | 20 years of carbon-free energy [2] |

| Amazon | $334M investment in SMRs at Hanford | 5000 MWe of new power by 2039 [2][10] |

| 500 MW agreement with Kairos Power | Development of novel SMRs in Tennessee [10] |

"At Meta, we believe nuclear energy will play a pivotal role in the transition to a cleaner, more reliable, and diversified electric grid."

- Meta [18]

Future Nuclear Tech

Nuclear power has long been valued for its reliable baseload energy, and new technologies are making it even more appealing. Companies like BWX Technologies are working on a 50 MW thermal microreactor with advanced uranium nitride fuel, targeting deployment in the early 2030s [19]. Westinghouse Electric Company is developing a 15 MW thermal reactor that can be installed in 30 days, with plans to roll it out by the late 2020s [19].

Kairos Power’s Hermes demonstration reactor in Oak Ridge is another exciting development. This 35-MW reactor uses TRISO fuel and a pebble bed design with molten fluoride salt coolant, paving the way for a 140-MW commercial reactor planned for 2026 [19].

The International Atomic Energy Agency (IAEA) predicts global nuclear capacity will grow 2.5 times by 2050, with Small Modular Reactors (SMRs) playing a central role [2]. With increasing government backing and private investments, nuclear power is set to be critical in powering AI data centers while helping meet environmental goals.

Nuclear energy is crucial in powering AI data centers but cannot meet the demand alone. With data center power expected to rise by 160% by 2030 [1], a combination of energy sources is essential to keep up.

Key Insights

Nuclear energy provides dependable, low-emission power, but its role is part of a larger energy strategy. Here's how the current landscape and future outlook break down:

| Factor | Current Status | Future Outlook |

|---|---|---|

| Power Capacity | Less than 10% of the required nuclear capacity (85-90 GW) by 2030 [1] | 31 countries aim to triple nuclear capacity by 2050 [20] |

| Energy Mix | Wind, solar, and storage could cover ~80% of data center needs [1] | Nuclear crucial for the remaining baseload demand |

| Infrastructure | Limited by labor shortages and complex permitting [1] | Increased government backing and private funding |

These points highlight the current state of nuclear energy and its potential future. Addressing capacity gaps, diversifying the energy mix, and overcoming infrastructure challenges are key to integrating nuclear energy into a broader energy strategy.

A balanced approach is critical to meeting the growing power demands of AI data centers. Nuclear energy’s steady output and low emissions must complement renewables, energy storage, and smarter grid systems. Achieving this will require technological advancements, streamlined regulations, and close cooperation across industries.